Investors flocked this past week to the stocks of public corporate giants whose CEOs joined President Donald Trump in announcing the up-to-$500 billion Stargate Project joint venture aimed at building artificial intelligence (AI) infrastructure—an effort promoted in part on its ability to help achieve the long-sought goal of developing a cancer vaccine.

Shares rose this week for Oracle (NASDAQ: ORCL) and SoftBank Group (OTCPK: SFTBY), two of the three principal companies carrying out SoftBank (the third company, ChatGPT developer OpenAI, is privately held).

Also recording increases were shares of three companies disclosed as tech partners of Stargate—Microsoft (NASDAQ: MSFT) OpenAI’s largest investor with a 49% stake translating to roughly $14 billion; Arm Holdings (NASDAQ: ARM), and Nvidia (NASDAQ: NVDA), the Silicon Valley microprocessing giant that has expanded its AI technologies and hardware into the life sciences and healthcare—most recently through a multi-omics collaboration with Illumina and a next-generation digital pathology partnership with Mayo Clinic.

Oracle, SoftBank, and OpenAI have joined as initial equity funders in Stargate, along with MGX—not the gene editing therapy developer Metagenomi (NASDAQ: MGX), but an Abu Dhabi-based AI and advanced tech investment firm that has invested in OpenAI. MGX in September joined Microsoft, BlackRock (NYSE: BLK), and Global AI Infrastructure Investment Partnership (GAIIP) to launch the up-to-$100 billion Global AI Infrastructure Investment Partnership (GAIIP), created to invest in data centers and supporting power infrastructure “chiefly” in the U.S. plus partner countries.

Stargate said it plans to invest $100 billion immediately, and $500 billion over the next four years, to build new AI infrastructure for OpenAI at sites in the U.S., starting with a data center under construction in Abilene, TX. Financial responsibility for Stargate will rest with SoftBank, whose Chairman and CEO Masayoshi Son will serve as chairman of the joint venture, while OpenAI has agreed to oversee its operations.

Investors reacted to the Stargate news Wednesday by snapping up shares of companies involved in the joint venture. Arm shares jumped 14.5%, from ($155.20 to $179.93), while SoftBank climbed 11% (from $30.73 to $34.10), and Oracle rose 7% (from $172.57 to $184.22) after surging 11% (to $191.99 at 8:16 a.m. in premarket trading).

The mini surges didn’t hold up Thursday, however. Arm fell 7% to $166.56, while SoftBank dipped 2% to $33.40, and Oracle inched up 1%, to $186.47.

“Validates Oracle’s capabilities”

“Oracle’s strategic positioning in the AI space is likely to drive substantial growth over the coming years. The Stargate initiative not only validates Oracle’s capabilities but also opens up new revenue streams,” Dan Ives, an analyst at Wedbush Securities, wrote in a research note, as reported by Indian news outlet Local Haryana.

Reporting smaller 4% increases Wednesday were Microsoft (from $428.50 to $446.20) and Nvidia (from $140.83 to $147.07). The following day, both companies barely rose 0.1%, with Nvidia finishing at $147.22 and Microsoft, at $446.71.

“Nvidia is delighted to push the limits of computing as OpenAI discovers the next frontier of AI,” a company spokesperson told GEN Edge.

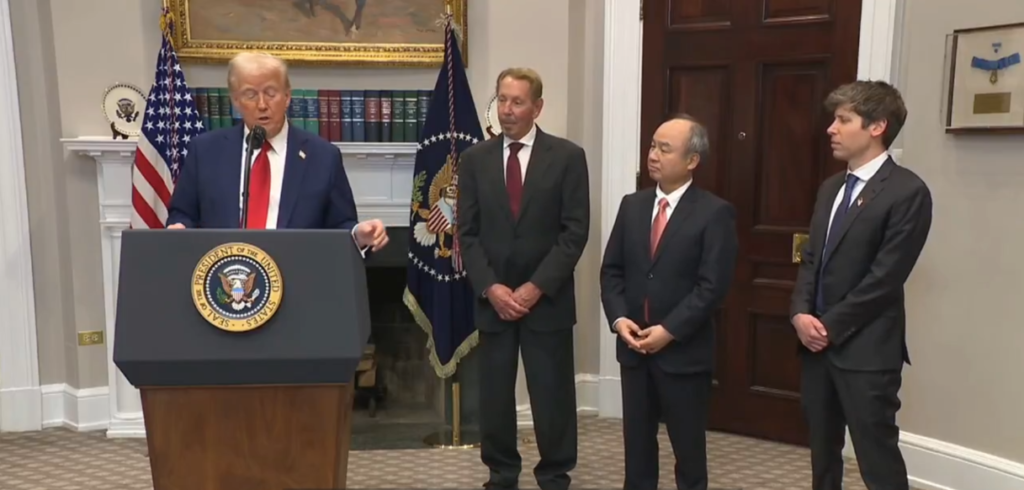

While Stargate’s focus is AI infrastructure, two of its key CEOs and Trump emphasized the joint venture’s potential applications in the life sciences and healthcare during a White House announcement of the joint venture.

“I hear so many positive things about what it’s going to do for medical research and for solving things, cancer and all the different problems,” Trump began.

OpenAI CEO Sam Altman followed up: “I believe that, as this technology progresses, we will see diseases get cured at an unprecedented rate,” citing cancer and heart disease before adding: “I think will be among the most important things this technology does.”

Larry Ellison, Oracle’s chairman and chief technology officer, elaborated on what he trumpeted as Stargate’s promise in fighting cancer: “Using AI—you can do early cancer detection with a blood test. And using AI to look at the blood test, you can find the cancers that are actually seriously threatening the person.”

“Cancer diagnosis using AI has the promise of just being a simple blood test. Then beyond that, once we gene-sequence, once we gene-sequence that cancer tumor, you can then vaccinate the person, design a vaccine for every individual person to vaccinate them against that cancer. And you can make that vaccine, that mRNA vaccine, you can make that robotically—again, using AI—in about 48 hours,” said Ellison, who founded Oracle in 1977 and served as its CEO until 2014.

“The promise of the future”

“Imagine early cancer detection, the development of a cancer vaccine for your particular cancer aimed at you, and hav[ing] that vaccine available in 48 hours. This is the promise of AI and the promise of the future.”

Cancer vaccine development was among the “Seven Biopharma Trends to Watch in 2025,” as highlighted by GEN earlier this month.

Ellison’s remarks about early cancer detection sparked a rally in shares of Grail (NASDAQ: GRAL), which Illumina (NASDAQ: ILMN) spun out in June following U.S. and European opposition to its $7.1 billion acquisition of the cancer blood-test developer. Grail’s shares leaped 40% since Tuesday just before the Stargate announcement, soaring 22% to $22.64 Wednesday and jumping another 15% Thursday to $25.97.

Leading cancer vaccine developers, however, saw smaller gains: Moderna (NASDAQ: MRNA) shares increased 7% Wednesday (from $35.89 to $38.50). However, its collaboration partner Merck & Co. (NYSE: MRK) dipped about 1%, (from $96.24 to $95.68), while cancer vaccine rival BioNTech (NASDAQ: BNTX) sank 2%, (from $117.25 to $115.17).

By Thursday, all three companies showed stock price growth. Moderna cracked double digits, rising 10% to $42.39, while BioNTech climbed 6% to $122.12, and Merck edged up about 1% to $96.63.

Leerink Partners analyst David Risinger offered a possible explanation for the initial stock price dips a day before they happened, writing in a research note that Merck and BioNTech, as with Moderna, were among vaccine developers potentially affected by Trump’s issuing an executive order Monday directing the U.S. to withdraw from the World Health Organization. As Risinger noted, the U.S. is the largest contributor to the WHO, representing approximately 16% of the organization’s funding.

“The news is negative for perception of vaccine manufacturers,” Risinger commented, “but practical implications are TBD.” In addition to BioNTech, Merck, and Moderna, the Leerink analyst included among potentially affected vaccine developers AstraZeneca (LSE: AZN), CSL (ASX: CSL), GlaxoSmithKline (LSE and NYSE: GSK), Novavax (NASDAQ: NVAX), Pfizer (NYSE: PFE), Sanofi (Euronext Paris: SAN), and Vaxcyte (NASDAQ: PCVX).

Trump faulted the WHO for “mishandling” the COVID-19 pandemic and other global health crises, failing to adopt “urgently needed” reforms, and for not demonstrating independence from “the inappropriate political influence of WHO member states.” The WHO responded by asserting that it implemented “the largest set of reforms in its history” over the past seven years, adding: “We hope the United States will reconsider and we look forward to engaging in constructive dialogue to maintain the partnership between the USA and WHO.”

News of Stargate has sparked public comment questioning the ability of partners to fulfill their financial commitment, as well as the wisdom of supporting cancer drug and vaccine development through the joint venture.

“The way to treat and prevent cancer isn’t to allocate $500 billion dollars at one approach while ignoring decades of other progress with other approaches and expertise,” Wafik S. El-Deiry, MD, PhD, director of the Legorreta Cancer Center at Brown University, contended on X.

El-Deiry noted that the NIH’s National Cancer Institute operates on an annual budget of $7.22 billion in Fiscal Year 2024, a level maintained through March 14, 2025 through a continuing resolution.

“Imagine what NCI can do with $50 billion per year,” he added.

“Why $500B?”

Separately, El-Deiry posted: “AI needs to prove what it adds as the drivers of cancer are well known by experts. Why $500B?”

Gavin Baker, Managing Partner & CIO of investment firm Atreides Management LP, asserted Wednesday on X that Stargate’s “$500B is a ridiculous number and no one should take it seriously unless SoftBank is going to sell all of their [Alibaba Group (NYSE)] BABA and ARM [shares].”

“SoftBank has $38B in cash, $142B in debt and generates $3ish billion in FCF [free cash flow] per BBG [Bloomberg]. They own $143B in ARM and $18B in BABA. If they start selling ARM, their stake will be worth much less very quickly. Oracle has $11B in cash, $88b in debt and generates $10b in FCF,” Baker elaborated.

Elon Musk, the Trump donor/ally and tech mogul whose own AI company xAI says it is “working on building artificial intelligence to accelerate human scientific discovery,” threw even chiller proverbial cold water on the joint venture by posting Tuesday on his social media platform X: “They don’t actually have the money.”

“SoftBank has well under $10B secured. I have that on good authority,” Musk also posted.

Not so, Altman shot back Wednesday on X: “[W]rong, as you surely know. [W]ant to come visit the first site already under way?”

“[t]his is great for the country. [I] realize what is great for the country isn’t always what’s optimal for your companies, but in your new role [I] hope you’ll mostly put [America] first,” Altman told Musk.

Another OpenAI competitor, Anthropic, this week won more than $1 billion in additional investment from Alphabet (NASDAQ: GOOG)-owned Google, the Financial Times reported, on top of $2.3 billion in two 2023 financings from the tech giant. These include a $2 billion investment which followed a $300 million funding that gave Google a 10% stake.

At the White House event, Son tied the joint venture to Trump’s “Make America Great Again” message, and to the president himself.

“Last month I came to celebrate your winning and promised that we would invest $100 billion,” Son recalled, addressing Trump. “And you told me, ‘Oh, Masa, go for $200 billion. Now I came back with $500 billion, because as you said [Monday], this is the beginning of the golden age of America.”