Thermo Fisher Scientific’s Accelerator™ Drug Development solutions, which integrate services for contract development and manufacturing organizations (CDMOs) and contract research organizations (CROs), can reduce oncology drug development timelines by up to nearly three years, according to a study commissioned by the company.

The study—a white paper titled “Value reimagined: Unlocking ROI and efficiency in drug development”—was conducted by the Tufts Center for the Study of Drug Development (CSDD) and released during the recent Biotechnology Innovation Organization (BIO) International Convention, held in Boston.

The white paper, which Thermo Fisher and Tufts said was under peer review, concluded that Accelerator could cut down on the standard 10- to 15-year timeframe for new drug development by shortening the time that candidates with cancer indications were in clinical trials from Phases I through III by up to nearly three years—34 months, to be exact.

“In summary, we think that the more complex the modality, the more time savings we realize,” Daniel Burch, MD, Thermo Fisher’s global head of biotech solutions, told GEN Edge.

While the white paper focused on cancer drug development, Burch added: “They [Tufts researchers] believe that the results are generalizable to other indications and modalities.”

The time and money savings come from factors beyond simply consolidating contract research and development vendors down to a single source. The time savings for clinical trials cited in the study reflected shorter dormant periods between the different phases of these studies or in between individual trials, what researchers and executives call “white space.”

“That white space was created because you have a lot of different decision makers. You may have miscommunication, you may have complexity, and you may not really have people who have the authority and accountability to manage the critical path of a trial. So, all the time savings come from that white space,” Burch explained.

“A major thrust of the paper is that the more services that a single vendor can put together and offer and integrate on behalf of a sponsor,” Burch added, “the more control they’re going to have on the timeline.”

Joseph DiMasi, PhD, the lead author of the white paper and Tufts’ director of economic analysis, noted in a statement that the cost of developing new drugs is worsened by operational inefficiencies from the siloing of clinical research, drug manufacturing, and supply chain functions.

Driver of value

“Our findings underscore the strategic importance of integrated services as a driver of value. Drug sponsors considering this approach should consider the degree of integration that would drive the most value for their programs,” stated DiMasi, who is also a research associate professor at Tufts. “Our study reveals that while fully integrated service provision yields the greatest financial benefit, even partial integration offers significant value, especially for the later phases of clinical development.”

As for money, the report analyzed risk-adjusted, discounted cash flow or “expected net present value” (eNPV) gains ranging from $45,000 for Phase I small molecule candidates to $62.9 million for Phase III oncology programs focused on developing monoclonal antibodies. Those gains translate into a return on investment (RoI) ranging from 0.2 to 113 times the initial investment.

The eNPV gain also reflects that a dollar saved today will likely be worth more than a dollar spent years from now due to inflation, Burch explained.

“We work on a lot of drugs that, when I was at Vanderbilt 30-plus years ago, I couldn’t have imagined,” recalled Burch, who trained in internal medicine at Vanderbilt University School of Medicine and in infectious disease at Washington University in St. Louis. “And the fact that we can bring these treatments to patients a couple of years or three years earlier is really amazing. It’s amazing for the patients that are waiting, as much as it is for our clients.”

The white paper did not address savings that could be generated from within a clinical trial, though Thermo Fisher and Tufts cited a 2023 study showing that each month of delay in a Phase III clinical trial could result in up to $8 million in lost revenue, resulting from shortened market exclusivity and deferred market entry.

Thermo Fisher partially supported the research behind the white paper through a grant to the Tufts CSDD.

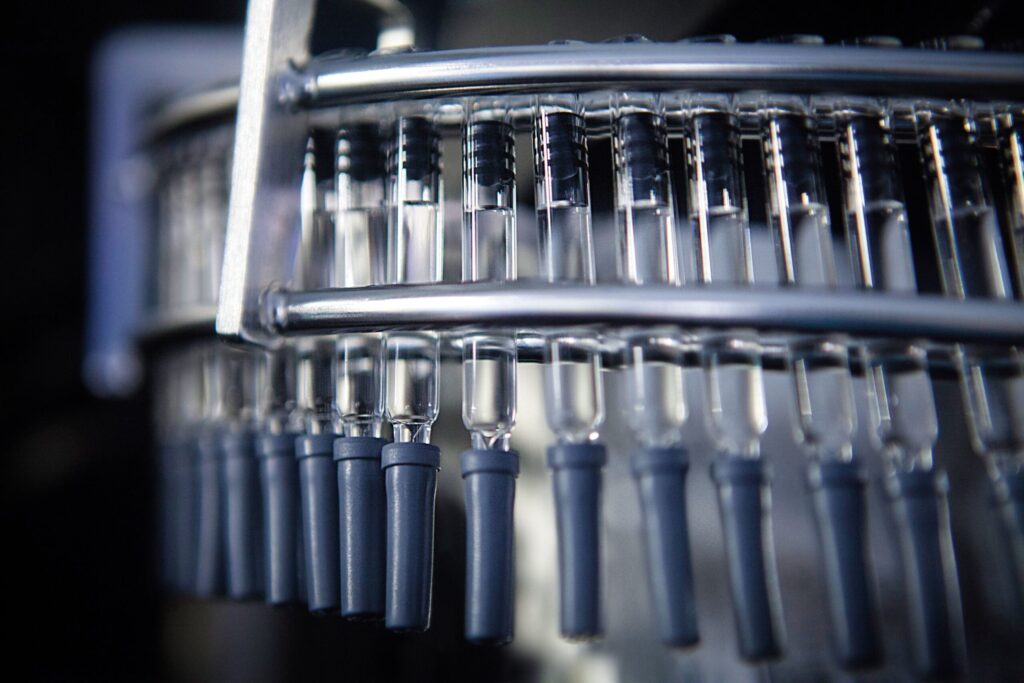

Accelerator is a customizable suite of manufacturing, clinical research, and clinical supply chain services intended to support the development of treatments ranging from small- to large-molecule drugs, oligonucleotides, proteins, peptides, mRNAs, biologics, cell therapies, and gene therapies. According to Thermo Fisher, Accelerator is designed to support customers at every stage of the development process, from preclinical studies to commercialization.

As of mid-June, when the Tufts study became public, more than 120 biotech and biopharma companies have worked with Thermo Fisher across its integrated CDMO and CRO solutions on more than 350 protocols across therapeutic areas—including small molecule, large molecule, and advanced therapy modalities.

Integrating and expanding

Thermo Fisher launched Accelerator last year to integrate and expand services long offered by PPD and Patheon—services that Thermo Fisher has since positioned as “360°” CDMO and CRO drug development solutions. Thermo Fisher expanded into the CDMO market by purchasing Patheon for approximately $7.2 billion, in a deal completed in 2017. Four years later, Thermo Fisher completed its $17.4 billion purchase of PPD, a deal that expanded the buyer into the CRO market.

What enhancements can customers expect to see in Accelerator over the coming months? More focus on satisfying a wide variety of biopharma customers, from giants to startups, Burch said.

“The really important thing in this business, especially for companies that don’t have revenue or don’t have profit, is time certainty. They want to deliver on time, and the fact that we have integrated service lines together allows us to convey time certainty to clients, and actually take more risk ourselves with the client on delivery,” Burch said.

In April, Thermo Fisher committed to investing $2 billion over the next four years toward supporting R&D and manufacturing needs for U.S. customers—part of the $200 billion-plus in commitments by tools/tech and drug developers across biopharma since Donald Trump’s election to a second term last November.

Thermo Fisher has said $1.5 billion of that total will consist of capital expenditures to enhance and expand U.S. manufacturing operations, while the other $500 million will be spent on R&D, with a focus on “high-impact” innovation.

Bolstering biomanufacturing

Thermo Fisher also moved to bolster its biomanufacturing services with a pair of recent announcements.

On June 17, during BIO, Thermo Fisher joined Cellular Origins, a TTP company, to announce an international collaboration of undisclosed value to deliver full, 24/7 robotic production of cell and gene therapies (CGTs) at industrial scale. The collaboration will combine Cellular Origins’ Constellation platform with Thermo Fisher’s cell culture and processing technology, with the aim of achieving the largest production output of CGTs per square meter of manufacturing space, plus the lowest labor requirements available within a digitally integrated framework.

And in February, Thermo Fisher agreed to acquire Solventum’s purification and filtration (PF) business for approximately $4.1 billion in cash, in a deal intended to provide purification and filtration technologies used in the production of biologics as well as in medical technologies and industrial applications. The acquisition is expected to close by the end of this year.

The investments in biomanufacturing contrast with what the Financial Times reported on June 12, citing unnamed sources, as Thermo Fisher’s plan to sell portions of its diagnostics business for $4 billion in response to recent cuts in NIH grant awards. Thermo Fisher won’t comment on the report, labeling it speculation.

“Whether you’re talking about small molecules, or biologics, or advanced therapies, we’re going to continue to meet the needs of the marketplace” by addressing potential production bottlenecks, such as the need for prefilled syringes, Burch said.

He added that Thermo Fisher is also investing in the production of more complex therapies, from active pharmaceutical ingredients to final drug products: “With relatively small patient numbers and trials, you’ve just got to get those right the first time.”